Welcome to SUSTAINABLE BUSINESS CONSULTING

Sustainability frameworks provide a clear way to handle environmental and social issues and help ensure long-term success. Knowing about these frameworks is key to staying competitive and meeting what stakeholders expect. Here’s why these frameworks are important and how they can benefit your company.

Everything you need to know about sustainability frameworks

Sustainability frameworks are comprehensive guidelines designed to help companies monitor, measure, and report their performance on environmental, social, and governance (ESG) matters. These frameworks enable businesses to assess the impact of their activities on the planet, people, and internal governance practices.

The primary goal of sustainability frameworks is to promote transparency and accountability. By adopting these frameworks, companies build trust with stakeholders—including customers, investors, and regulators—by demonstrating their commitment to responsible and ethical practices.

Why do sustainability frameworks matter for businesses?

Implementing sustainability frameworks strengthens a company’s reputation and fosters trust among stakeholders. Transparent reporting signals a commitment to accountability, making the business more appealing to customers and investors. This, in turn, enhances brand loyalty and long-term relationships.

Governments worldwide are increasingly introducing regulations mandating ESG disclosures. Adopting recognized frameworks ensures compliance with these laws, helping companies avoid penalties and legal challenges. Moreover, staying ahead of regulatory changes positions businesses as industry leaders.

Sustainability frameworks encourage resource efficiency and waste reduction, resulting in cost savings and improved profitability. These frameworks also spur innovation by encouraging the adoption of sustainable practices, opening doors to new business opportunities.

Proactively addressing ESG issues through sustainability frameworks helps companies identify and manage risks before they escalate. This includes minimizing exposure to environmental disruptions, social conflicts, or governance failures, ensuring smoother operations and resilience.

Investors are increasingly prioritizing sustainability in their decision-making. Adherence to well-established frameworks signals a company’s dedication to ESG principles, attracting funding and investment opportunities that align with long-term growth objectives.

Sustainability frameworks enable businesses to plan by integrating ESG considerations into their core strategies. This ensures resilience against market volatility and societal pressures, contributing positively to both the environment and communities.

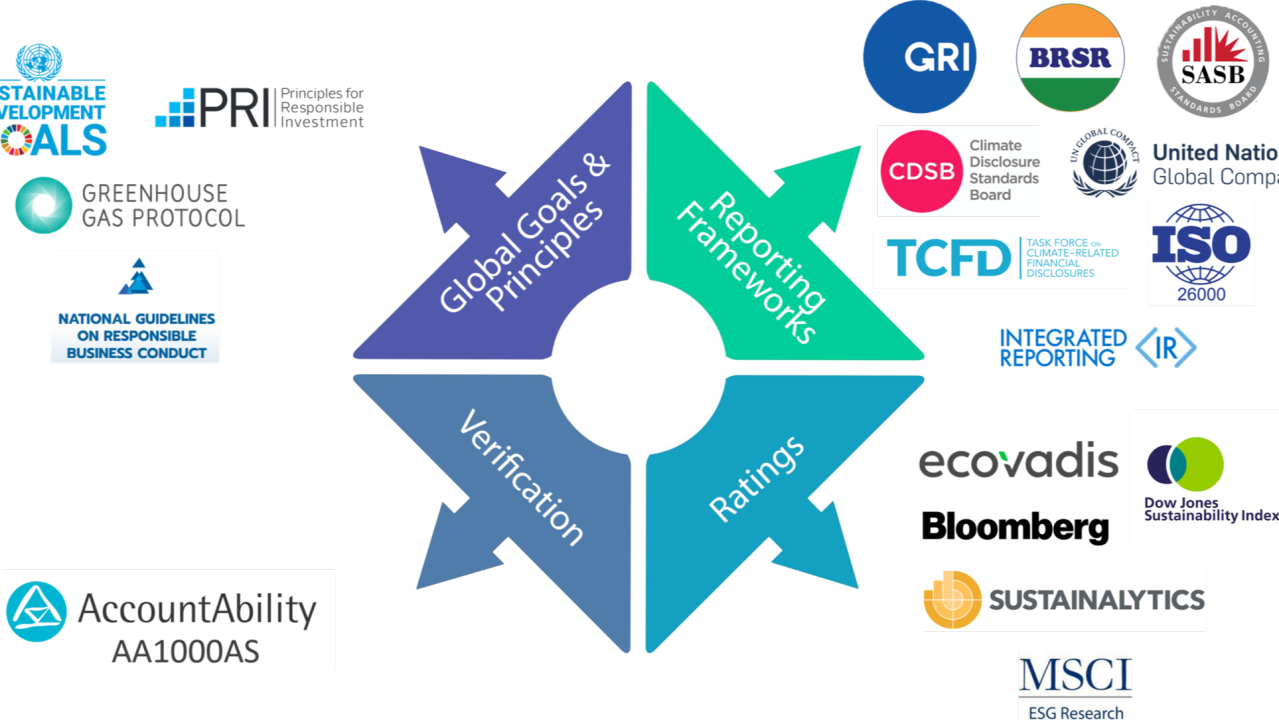

Sustainability frameworks are typically built around three main components:

While sustainability frameworks share common objectives, they often focus on specific aspects of ESG performance. Here are the three main types:

Environmental frameworks emphasize reducing ecological footprints and promoting sustainable practices. For instance, the Global Reporting Initiative (GRI) offers guidelines to measure environmental impacts like carbon emissions, resource usage, and waste management. By adopting these frameworks, companies can transition to eco-friendly operations while meeting global sustainability goals.

Social frameworks focus on the human dimension of business operations. They assess how companies treat employees, interact with customers, and contribute to society. For example, the Sustainability Accounting Standards Board (SASB) provides standards to evaluate workforce diversity, employee well-being, and community involvement.

Governance frameworks address ethical and regulatory compliance in corporate management. They evaluate board diversity, executive remuneration, and anti-corruption measures. The Task Force on Climate-related Financial Disclosures (TCFD) offers guidance on managing risks associated with climate change, fostering trust and accountability among investors.

The GRI is one of the most widely recognized frameworks for sustainability reporting. It offers comprehensive standards to help companies disclose their environmental, social, and economic impacts. GRI’s emphasis on transparency and stakeholder inclusiveness builds trust and facilitates informed decision-making.

Key features:

SASB focuses on industry-specific sustainability issues that directly influence financial performance. By aligning ESG factors with financial reporting, SASB helps businesses provide meaningful data to investors.

Key features:

The Task Force on Climate-related Financial Disclosures (TCFD) was developed to guide companies in disclosing how climate change might affect their operations. Its primary goal is to provide consistent and comparable information about climate-related risks and opportunities, allowing businesses and investors to make informed decisions.

Key aspects of TCFD:

The Carbon Disclosure Project (CDP) focuses on environmental transparency, particularly concerning greenhouse gas emissions. It provides a platform for companies to report their environmental data, thereby promoting accountability and encouraging sustainable practices.

Key features of CDP:

Selecting the most suitable sustainability framework is a crucial step in achieving meaningful and measurable progress in sustainability. Here are key considerations to guide this process:

Begin by identifying your organization’s sustainability objectives. Are you aiming to reduce carbon emissions, improve social practices, or enhance governance? For example, if reducing environmental impact is a priority, a framework like CDP may be most appropriate. Aligning your goals with the framework’s focus ensures relevance and effectiveness.

Each industry faces unique challenges and opportunities. For instance, a technology company might prioritize digital sustainability, while a manufacturing firm may focus on energy efficiency and waste reduction. Frameworks like the Sustainability Accounting Standards Board (SASB) offer industry-specific standards that address such concerns.

Different frameworks cover varying aspects of sustainability. For example, the Global Reporting Initiative (GRI) addresses a wide range of topics, including environmental, social, and governance issues, while TCFD focuses specifically on climate-related financial risks. Assessing the scope of each framework helps you determine which one aligns with your reporting needs.

Understanding how a framework integrates with your existing reporting practices is essential. Some frameworks, like SASB and TCFD, are designed to complement traditional financial reports, while others, such as GRI and CDP, may require more detailed and specific sustainability reporting. Choosing a framework compatible with your current processes can streamline implementation.

Consider the preferences of key stakeholders such as investors, customers, and regulators. For instance, investors may favor frameworks like SASB or TCFD that focus on financial impacts, while broader frameworks like GRI might appeal to customers and other stakeholders who value comprehensive sustainability reporting.

Ensure that the chosen framework aligns with your industry and geographical context. Certain frameworks cater to specific sectors or regions, making them more relevant for your sustainability initiatives. This can also help you comply with local regulations and address regional concerns effectively.

opt for a framework that is adaptable and regularly updated to reflect evolving sustainability practices. Flexibility ensures that your company’s sustainability efforts remain relevant and effective over time. Regular updates also help address emerging trends and challenges in sustainability.

Adopting and maintaining a sustainability framework involves costs, including investments in training, data collection, and reporting. Assess whether the benefits of the framework outweigh these costs and ensure that your organization has the necessary resources for effective implementation.

The first step in adopting a sustainability framework is to evaluate your existing practices. Identify areas where your company can improve by examining your environmental, social, and governance (ESG) impacts. Conduct a thorough gap analysis to understand how your operations align with the standards of potential frameworks. This process will help you pinpoint the adjustments needed to meet your goals effectively.

For example, if your organization has high energy consumption, investigate frameworks that emphasize energy efficiency and renewable energy adoption. If your focus is on social responsibility, consider frameworks that prioritize equitable labor practices and community engagement. Tailoring your choice of framework to your specific needs ensures that your efforts are impactful and aligned with your objectives.

A crucial component of implementing sustainability is involving your stakeholders. Employees, customers, investors, and even suppliers have expectations regarding your sustainability efforts. Engaging with them helps you gather valuable insights and align your actions with their priorities.

Once you’ve chosen a sustainability framework, it’s time to integrate it into your business operations. Begin by setting clear, measurable goals and defining a roadmap for achieving them. For example, if you adopt the Global Reporting Initiative (GRI) standards, establish specific targets such as reducing greenhouse gas emissions by a certain percentage or increasing community investment.

Contact Form